Class Action Suit: A Double Edged Sword for Corporate Devils!

An over view

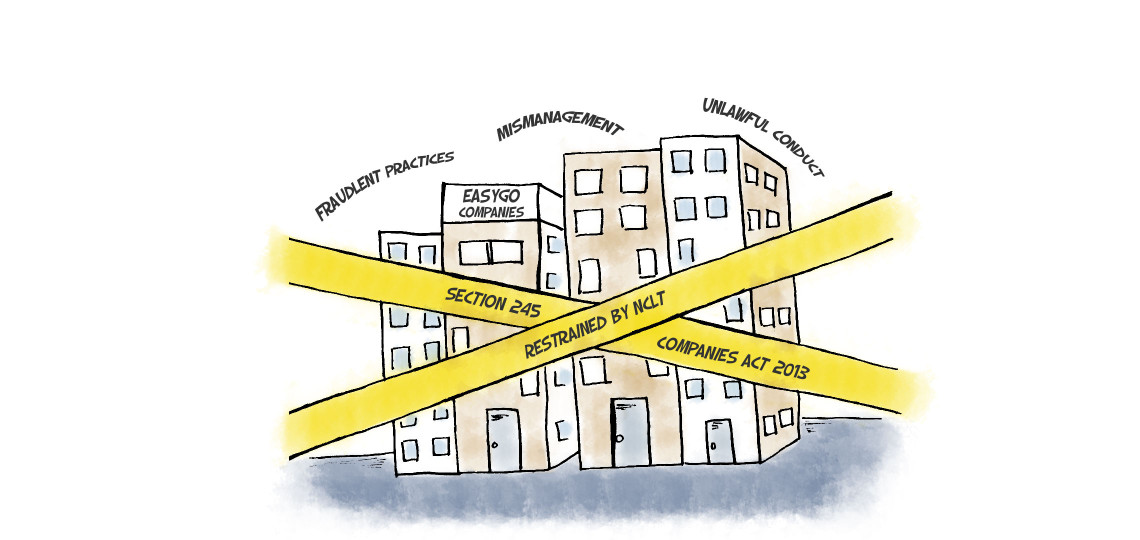

Section 245, of the Companies Act, 2013 contains provisions in respect of Class Action Suit. The concept of Class Action Suit has been introduced under the Companies Act, 2013 to bring the Indian Companies Act in line with the developed countries.

The provisions with regard to Class Action Suit were incorporated under the Companies Act, 2013 when India witnessed nerve wrecking corporate frauds. The main objective to introduce Class Action Suit under Companies Act, 2013 is to protect the interest of the members, depositors and to prohibit companies from committing acts ultra vires the provisions of the Act.

Satyam Saga

The shareholders of Satyam saw their investment tank from heights of Rs.528 per share to Rs.6.30 per share post disclosure of the Accounting fraud by Mr. Ramalingam Raju. The shareholders of Satyam Computers witnessed a sudden jolt after Mr.Ramalingam Raju confessed to the manipulation of accounting books of Satyam Computers. While the erstwhile Companies Act, 1956 was successful in punishing the offender, it was unsuccessful in bringing relief to the shareholders who lost heavily on account of the fraudulent practices. The Companies Act, 2013 has come to the rescue of shareholders who were left penniless after the value of their shares substainably collapsed due to the fraudulent activities of the promoters and management. The Companies Act, 2013 has provided a very good combination where the offender will be punished and the people who are involved will be liable even for a class action, wherein they have to compensate the shareholders and depositors for the losses caused to them on account of the fraudulent practices.

What is a Class Action Suit?

In simple terms, A Class Action Suit refers to a lawsuit whereby a particular class of people or group can collectively file a Suit against a particular Company to which they are associated if the Company conducts any act prejudicial or detrimental to their interest.

Who can file a Class Action Suit?

As per Section 245 of the Companies Act members or depositors of a Company can file a Class Action Suit against that Company, provided there must be atleast one hundred members in case of a company having share capital and not less than one-fifth of the total number of members in case of a company not having a share capital. The requisite number of depositors shall not be less than one hundred depositors.

When can a Class Action Suit be filed under the Companies Act, 2013

A Class Action Suit can be filed against the Company if the members or depositors are of the opinion that the management and conduct of the affairs of the company are being conducted in a manner prejudicial to the interest of the company or its members or depositors.

Against whom can a Class Action Suit be filed?

A Class Action Suit can be filed against the company or its directors, its auditor including audit firm of the company, any expert or adviser or consultant or any other person for any incorrect or misleading statement made to the company or for any fraudulent, unlawful or wrongful act or conduct or any likely act or conduct on their part.

Adjudicating Forum

The members or depositors as the case may be can file a Class Action Suit with the National Company Law Tribunal established under jurisdiction of the respective State where the registered office of the Company is situated.

What reliefs can be claimed?

- To restrain the Company from committing an act which is ultra vires the articles or memorandum of the company;

- To restrain the company from committing breach of any provision of the company’s memorandum or articles;

- To declare a resolution altering the memorandum or articles of the company as void if the resolution was passed by suppression of material facts or obtained by mis-statement to the members or depositors;

- To retrain the company and its directors from acting on such resolution;

- To restrain the company from doing act which is contrary to the provisions of the Companies Act or any other law for the time being in force;

- To restrain the company from taking action contrary to any resolution passed by the members;

- To claim damages or compensation or demand any other suitable action from or against

- The company or its directors for any fraudulent, unlawful or wrongful act or omission or conduct or any likely act or omission or conduct on its or their part;

- The auditor including audit firm of the company for any improper or misleading statement of particulars made in his audit report or for any fraudulent, unlawful or wrongful act or conduct; or

- Any expert or advisor or consultant or any other person for any incorrect or misleading statement made to the company or for any fraudulent, unlawful or wrongful act or conduct or any likely act or conduct on his part;

- To seek any other remedy as the Tribunal may think fit.

- To seek any other remedy as the Tribunal may think fit.

Unreasonableness

The Tribunal if finds that the application is frivolous or vexatious it shall reject the application and make an order that the applicant shall pay cost to the opposite party.

Conclusion

The introduction of Class Action Suit in the Companies Act, 2013 is a weapon of choice to members and depositors. It is a caveat to the management and the promoters including auditors, experts or consultants to conduct the affairs in the interest of the members and depositors. It will instill confidence among the members and depositors and will raise the standard of corporate governance in the Corporate World. Class Action Suit is a step towards strengthening corporate democracy.

Private Placement and Preferential Allotment

Designation of Special Courts

Leave a comment

You must be logged in to post a comment.

He holds a Bachelor’s and Master’s Degree in Corporate Secretaryship and a Degree in Law. He is a Fellow member of the Institute of Company Secretaries of India and an Associate Member of the Corporate Governance Institute, UK and Ireland. He has also completed a program from ISB on ‘Value Creation through Mergers and Acquisitions.

He holds a Bachelor’s and Master’s Degree in Corporate Secretaryship and a Degree in Law. He is a Fellow member of the Institute of Company Secretaries of India and an Associate Member of the Corporate Governance Institute, UK and Ireland. He has also completed a program from ISB on ‘Value Creation through Mergers and Acquisitions. Mr P Muthusamy is an Indian Revenue Service (IRS) officer with an outstanding career of 30+ years of experience and expertise in all niche areas of Indirect Taxes covering a wide spectrum including GST, Customs, GATT Valuation, Central Excise and Foreign Trade.

Mr P Muthusamy is an Indian Revenue Service (IRS) officer with an outstanding career of 30+ years of experience and expertise in all niche areas of Indirect Taxes covering a wide spectrum including GST, Customs, GATT Valuation, Central Excise and Foreign Trade. During his judicial role, he heard and decided a large number of cases, including some of the most sensitive, complicated, and high-stake matters on insolvency and bankruptcy, including many cases on resolution plans, shareholder disputes and Schemes of Amalgamation, De-mergers, restructuring etc.,

During his judicial role, he heard and decided a large number of cases, including some of the most sensitive, complicated, and high-stake matters on insolvency and bankruptcy, including many cases on resolution plans, shareholder disputes and Schemes of Amalgamation, De-mergers, restructuring etc., Ms. Sarah Abraham has been enrolled with the Bar Council of Tamil Nadu since 1998. Her areas of practice include Shareholder Disputes, Corporate Compliances, Mergers and Acquisitions, Private Equity/ Venture Capital Agreements and allied disputes, Information Technology Contracts, Intellectual Property, General Commercial Agreements, Litigation, Arbitration and Mediation.

Ms. Sarah Abraham has been enrolled with the Bar Council of Tamil Nadu since 1998. Her areas of practice include Shareholder Disputes, Corporate Compliances, Mergers and Acquisitions, Private Equity/ Venture Capital Agreements and allied disputes, Information Technology Contracts, Intellectual Property, General Commercial Agreements, Litigation, Arbitration and Mediation. A K Mylsamy is the Founder, Managing Partner and the anchor of the firm. He holds a Degree in law and a Degree in Literature. He is enrolled with the Bar Council of Tamil Nadu.

A K Mylsamy is the Founder, Managing Partner and the anchor of the firm. He holds a Degree in law and a Degree in Literature. He is enrolled with the Bar Council of Tamil Nadu. M Subathra holds a Degree in law and a Master’s Degree in International Business Law from the University of Manchester, United Kingdom. She is enrolled with the Bar Council of Tamil Nadu.

M Subathra holds a Degree in law and a Master’s Degree in International Business Law from the University of Manchester, United Kingdom. She is enrolled with the Bar Council of Tamil Nadu. Mr. K Rajendran is a former Indian Revenue Service (IRS) officer with a distinguished service of 35 years in the Indirect Taxation Department with rich experience and expertise in the fields of Customs, Central Excise, Service Tax and GST. He possesses Master’s Degree in English literature. Prior to joining the Department, he served for the All India Radio, Coimbatore for a period of about 4 years.

Mr. K Rajendran is a former Indian Revenue Service (IRS) officer with a distinguished service of 35 years in the Indirect Taxation Department with rich experience and expertise in the fields of Customs, Central Excise, Service Tax and GST. He possesses Master’s Degree in English literature. Prior to joining the Department, he served for the All India Radio, Coimbatore for a period of about 4 years. An MBA from the Indian Institute of Management, Calcutta, and an M.Sc. in Tourism Management from the Scottish Hotel School, UK, Ashok Anantram was one fo the earliest IIM graduates to enter the Indian hospitality industry. He joined India Tourism Development Corporation (ITDC) in 1970 and after a brief stint proceeded to the UK on a scholarship. On his return to India, he joined ITC Hotels Limited in 1975. Over the 30 years in this Organisation, he held senior leadership positions in Sales & Marketing and was its Vice President – Sales & Marketing. He was closely involved in decision making at the corporate level and saw the chain grow from a single hotel in 1975 to a very large multi-brand professional hospitality group.

An MBA from the Indian Institute of Management, Calcutta, and an M.Sc. in Tourism Management from the Scottish Hotel School, UK, Ashok Anantram was one fo the earliest IIM graduates to enter the Indian hospitality industry. He joined India Tourism Development Corporation (ITDC) in 1970 and after a brief stint proceeded to the UK on a scholarship. On his return to India, he joined ITC Hotels Limited in 1975. Over the 30 years in this Organisation, he held senior leadership positions in Sales & Marketing and was its Vice President – Sales & Marketing. He was closely involved in decision making at the corporate level and saw the chain grow from a single hotel in 1975 to a very large multi-brand professional hospitality group. Mani holds a Bachelor Degree in Science and P.G. Diploma in Journalism and Public Relations. He has a rich and varied experience of over 4 decades in Banking, Finance, Hospitality and freelance Journalism. He began his career with Andhra Bank and had the benefit of several training programs in Banking.

Mani holds a Bachelor Degree in Science and P.G. Diploma in Journalism and Public Relations. He has a rich and varied experience of over 4 decades in Banking, Finance, Hospitality and freelance Journalism. He began his career with Andhra Bank and had the benefit of several training programs in Banking. Mr. Kailash Chandra Kala joined the Department of Revenue, Ministry of Finance as ‘Customs Appraiser’ at Mumbai in the year 1993.

Mr. Kailash Chandra Kala joined the Department of Revenue, Ministry of Finance as ‘Customs Appraiser’ at Mumbai in the year 1993.

S Ramanujam, is a Chartered Accountant with over 40 years of experience and specialization in areas of Corporate Tax, Mergers or Demergers, Restructuring and Acquisitions. He worked as the Executive Vice-President, Group Taxation of the UB Group, Bangalore.

S Ramanujam, is a Chartered Accountant with over 40 years of experience and specialization in areas of Corporate Tax, Mergers or Demergers, Restructuring and Acquisitions. He worked as the Executive Vice-President, Group Taxation of the UB Group, Bangalore. K K Balu holds a degree in B.A and B.L and is a Corporate Lawyer having over 50 years of Legal, Teaching and Judicial experience.

K K Balu holds a degree in B.A and B.L and is a Corporate Lawyer having over 50 years of Legal, Teaching and Judicial experience. Justice M. Jaichandren hails from an illustrious family of lawyers, academics and politicians. Justice Jaichandren majored in criminology and then qualified as a lawyer by securing a gold medal. He successfully practiced in the Madras High Court and appeared in several civil, criminal, consumer, labour, administrative and debt recovery tribunals. He held office as an Advocate for the Government (Writs Side) in Chennai and was on the panel of several government organizations as senior counsel. His true passion lay in practicing Constitutional laws with focus on writs in the Madras High Court. He was appointed Judge, High Court of Madras in December 2005 and retired in February 2017.

Justice M. Jaichandren hails from an illustrious family of lawyers, academics and politicians. Justice Jaichandren majored in criminology and then qualified as a lawyer by securing a gold medal. He successfully practiced in the Madras High Court and appeared in several civil, criminal, consumer, labour, administrative and debt recovery tribunals. He held office as an Advocate for the Government (Writs Side) in Chennai and was on the panel of several government organizations as senior counsel. His true passion lay in practicing Constitutional laws with focus on writs in the Madras High Court. He was appointed Judge, High Court of Madras in December 2005 and retired in February 2017. S Balasubramanian is a Commerce and Law Graduate. He is a member of the Delhi Bar Council, an associate Member of the Institute of Chartered Accountants of India, the Institute of Company Secretaries of India and Management Accountants of India.

S Balasubramanian is a Commerce and Law Graduate. He is a member of the Delhi Bar Council, an associate Member of the Institute of Chartered Accountants of India, the Institute of Company Secretaries of India and Management Accountants of India.