Insider Trading

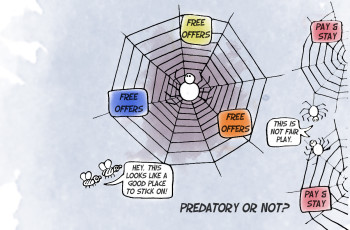

Insider Trading is the trading of listed company’s securities by individuals with access to non-public information about the company. Insider Trading is seen as an unfair practice to other investors who do not have access to the price sensitive information as the investor with insider information could potentially make larger profits compared to that of a typical investor.

Rationale behind prohibition of insider trading

The smooth operation of the securities market and its healthy growth and development depends on a large extent on the quality and integrity of the market. Such a market can alone inspire confidence in investors. Insider trading leads investors to lose confidence in the securities market as they feel that the market is rigged and only few, who have inside information benefit and make profits from their investments. Thus, the process of insider trading corrupts the ‘level playing field’.

Hence the practice of insider trading is intended to be prohibited in order to sustain the investor’s confidence in the integrity of the security market. 1

Insider Trading – A menace to Corporate Governance

Corporate Governance is a term which is often associated with the aspect of ensuring transparency to stakeholders. In India most of the big companies are listed on any one of the recognized stock exchanges namely the BSE or the NSE. The actions of the companies that are listed in the stock exchanges have a bearing on their stock prices in the market when their securities are traded. In such cases care must be taken to ensure that the actions of the company are fair and not detrimental to its investors. Often there is lack of transparency between the corporate entity and shareholders. Hence its regarded as a menace to corporate governance. 2

Insider Trading Regulations,2015 -An overview

The new Insider Trading Regulation(‘Regulation’) has brought about drastic changes by amending the definitions of various concepts. The Regulation comprises of 15 Chapters, 2 Schedules and 12 Sections.

Salient features of the Regulation are as follows:

- The Regulations are effective from May 15,2015.

- The definition of an “Insider” 3 has been simplified to mean any person who is a “connected person” and those in possession of “Unpublished Price Sensitive Information” (“UPSI”).

- The scope of “Connected Person” 4 under the Regulations has been widened to include persons associated with the company in a contractual, fiduciary or employment relationship or having direct or indirect access to Unpublished Price Sensitive Information.

- “Trading” 5 under the Regulation means and includes subscribing, buying, selling, dealing or agreeing to subscribe, buy, sell or deal in any securities, and “trade” shall be construed accordingly.

- Multiple restrictions have been placed i.e. (i) prohibition on communication of unpublished price sensitive information (ii) procurement of unpublished price sensitive information and (iii) trading in securities when in possession of unpublished price sensitive information.

Restrictions on Insiders

Regulation 3(1) of SEBI (PIT) Regulations,2015 leads to statutory restriction on all insiders not to communicate, provide or allow access to any UPSI related to a company or securities listed or proposed to be listed to any person including other insiders until and unless providing such information or allowing their access is absolutely for legitimate purposes or performance of their duties and in discharge of legal obligations.

It was observed by Hon’ble SAT in the matter of Rakesh Agarwal V. SEBI that Regulation 3 must be interpreted bearing in mind the basic underlying assumption and the intent of the legislature in introducing such Regulations. The Regulation was never intended as an all-purpose ban on trading. Legitimate transactions undertake to achieve a corporate purpose or to discharge a fiduciary duty or in the interest of a body of public shareholders or stakeholders in a company or transactions in the public interest. The whole Regulation is an anti-fraud regulation.

Trading Plan

The concept of “Trading Plan” 6 is introduced for the first time in India on an experimental basis. The fundamental principle governing the trading plan is to maintain the prohibition on trading in securities when in possession of UPSI as well as facilitate an establishment of regime in which compliance-conscious insiders are able to put in place a compliant mechanism to trade in securities where they are insiders.

The features of Trading Plans are as follows:

- Trading Plan need to be approved by compliance officer and also to be disclosed to the stock exchange before commencement of trading in accordance with such trading plan.

- Trading Plan should be for 12 months.

- Two trading plan should not overlap.

- Trading is not allowed on behalf of insider earlier than 6 months from the public disclosure.

- Trading is not allowed between 20th trading day prior to last day of any financial period and the second day after the disclosure is made to the public.

- Trading plan must mention either the total value or total number of securities, nature of trade and dates on which such trades shall be effected.

- Deviation from the trading plan is now allowed and it must be honored. Also approved trading plan cannot be revoked.

Penalties

No separate penalties have been prescribed under the Regulations. Reference is made however to the penalty provisions under the SEBI Act, 1992 which shall apply. 7

Comparison Between India and US Insider Trading Laws

Sl. No. |

Issue |

India |

United States |

| 1. | Governing Laws | Securities and Exchange Board of India Act, 1992 | Securities Act of 1933 and Securities Exchange Act of 1934 |

| 2. | Nature of offence | It is only an Economic Offence and not a Criminal Offence. | It is both a Civil and a Criminal Offence |

| 3. | Regulatory Authority | Securities and Exchange Board of India. | Securities Exchange Commission. |

| 4. | Punishment | Fine upto 25 crores or three times the profit made out of Insider Trading. | 20 Years in Prison and a fine of 5 million US Dollars. |

Insider Trading under Companies Act,2013

1. Section 195 of the Companies Act,2013(‘Section’) is a new provision and provides that no person including any director or key managerial personnel of a company shall engage in insider trading.

2. Any violation of the Section by any person shall be punishable with imprisonment for a term which may extend to 5 years or with fine which shall not be less than Rs. 5 lakhs and which shall not exceed Rs.25 crores or three times the amount of profits made out of insider trading, whichever is higher, or with both.

Conclusion

Insider Trading is essentially the wrong of trading in securities with the advantage of having asymmetrical access to Unpublished Price Sensitive Information which when published would impact the price of securities in the market. The Regulation being a stringent one ensures a fair level playing field in the securities market and to safeguard the interest of the investors, and this move by SEBI will facilitate further economic buoyancy in the Indian Capital Market.

Investment Policy, Liquid Assets for the purpose of Calculation of Net Worth of a Clearing Corporation and Transfer of Profits

Related Party Transaction

Leave a comment

You must be logged in to post a comment.

He holds a Bachelor’s and Master’s Degree in Corporate Secretaryship and a Degree in Law. He is a Fellow member of the Institute of Company Secretaries of India and an Associate Member of the Corporate Governance Institute, UK and Ireland. He has also completed a program from ISB on ‘Value Creation through Mergers and Acquisitions.

He holds a Bachelor’s and Master’s Degree in Corporate Secretaryship and a Degree in Law. He is a Fellow member of the Institute of Company Secretaries of India and an Associate Member of the Corporate Governance Institute, UK and Ireland. He has also completed a program from ISB on ‘Value Creation through Mergers and Acquisitions. Mr P Muthusamy is an Indian Revenue Service (IRS) officer with an outstanding career of 30+ years of experience and expertise in all niche areas of Indirect Taxes covering a wide spectrum including GST, Customs, GATT Valuation, Central Excise and Foreign Trade.

Mr P Muthusamy is an Indian Revenue Service (IRS) officer with an outstanding career of 30+ years of experience and expertise in all niche areas of Indirect Taxes covering a wide spectrum including GST, Customs, GATT Valuation, Central Excise and Foreign Trade. During his judicial role, he heard and decided a large number of cases, including some of the most sensitive, complicated, and high-stake matters on insolvency and bankruptcy, including many cases on resolution plans, shareholder disputes and Schemes of Amalgamation, De-mergers, restructuring etc.,

During his judicial role, he heard and decided a large number of cases, including some of the most sensitive, complicated, and high-stake matters on insolvency and bankruptcy, including many cases on resolution plans, shareholder disputes and Schemes of Amalgamation, De-mergers, restructuring etc., Ms. Sarah Abraham has been enrolled with the Bar Council of Tamil Nadu since 1998. Her areas of practice include Shareholder Disputes, Corporate Compliances, Mergers and Acquisitions, Private Equity/ Venture Capital Agreements and allied disputes, Information Technology Contracts, Intellectual Property, General Commercial Agreements, Litigation, Arbitration and Mediation.

Ms. Sarah Abraham has been enrolled with the Bar Council of Tamil Nadu since 1998. Her areas of practice include Shareholder Disputes, Corporate Compliances, Mergers and Acquisitions, Private Equity/ Venture Capital Agreements and allied disputes, Information Technology Contracts, Intellectual Property, General Commercial Agreements, Litigation, Arbitration and Mediation. A K Mylsamy is the Founder, Managing Partner and the anchor of the firm. He holds a Degree in law and a Degree in Literature. He is enrolled with the Bar Council of Tamil Nadu.

A K Mylsamy is the Founder, Managing Partner and the anchor of the firm. He holds a Degree in law and a Degree in Literature. He is enrolled with the Bar Council of Tamil Nadu. M Subathra holds a Degree in law and a Master’s Degree in International Business Law from the University of Manchester, United Kingdom. She is enrolled with the Bar Council of Tamil Nadu.

M Subathra holds a Degree in law and a Master’s Degree in International Business Law from the University of Manchester, United Kingdom. She is enrolled with the Bar Council of Tamil Nadu. Mr. K Rajendran is a former Indian Revenue Service (IRS) officer with a distinguished service of 35 years in the Indirect Taxation Department with rich experience and expertise in the fields of Customs, Central Excise, Service Tax and GST. He possesses Master’s Degree in English literature. Prior to joining the Department, he served for the All India Radio, Coimbatore for a period of about 4 years.

Mr. K Rajendran is a former Indian Revenue Service (IRS) officer with a distinguished service of 35 years in the Indirect Taxation Department with rich experience and expertise in the fields of Customs, Central Excise, Service Tax and GST. He possesses Master’s Degree in English literature. Prior to joining the Department, he served for the All India Radio, Coimbatore for a period of about 4 years. An MBA from the Indian Institute of Management, Calcutta, and an M.Sc. in Tourism Management from the Scottish Hotel School, UK, Ashok Anantram was one fo the earliest IIM graduates to enter the Indian hospitality industry. He joined India Tourism Development Corporation (ITDC) in 1970 and after a brief stint proceeded to the UK on a scholarship. On his return to India, he joined ITC Hotels Limited in 1975. Over the 30 years in this Organisation, he held senior leadership positions in Sales & Marketing and was its Vice President – Sales & Marketing. He was closely involved in decision making at the corporate level and saw the chain grow from a single hotel in 1975 to a very large multi-brand professional hospitality group.

An MBA from the Indian Institute of Management, Calcutta, and an M.Sc. in Tourism Management from the Scottish Hotel School, UK, Ashok Anantram was one fo the earliest IIM graduates to enter the Indian hospitality industry. He joined India Tourism Development Corporation (ITDC) in 1970 and after a brief stint proceeded to the UK on a scholarship. On his return to India, he joined ITC Hotels Limited in 1975. Over the 30 years in this Organisation, he held senior leadership positions in Sales & Marketing and was its Vice President – Sales & Marketing. He was closely involved in decision making at the corporate level and saw the chain grow from a single hotel in 1975 to a very large multi-brand professional hospitality group. Mani holds a Bachelor Degree in Science and P.G. Diploma in Journalism and Public Relations. He has a rich and varied experience of over 4 decades in Banking, Finance, Hospitality and freelance Journalism. He began his career with Andhra Bank and had the benefit of several training programs in Banking.

Mani holds a Bachelor Degree in Science and P.G. Diploma in Journalism and Public Relations. He has a rich and varied experience of over 4 decades in Banking, Finance, Hospitality and freelance Journalism. He began his career with Andhra Bank and had the benefit of several training programs in Banking. Mr. Kailash Chandra Kala joined the Department of Revenue, Ministry of Finance as ‘Customs Appraiser’ at Mumbai in the year 1993.

Mr. Kailash Chandra Kala joined the Department of Revenue, Ministry of Finance as ‘Customs Appraiser’ at Mumbai in the year 1993.

S Ramanujam, is a Chartered Accountant with over 40 years of experience and specialization in areas of Corporate Tax, Mergers or Demergers, Restructuring and Acquisitions. He worked as the Executive Vice-President, Group Taxation of the UB Group, Bangalore.

S Ramanujam, is a Chartered Accountant with over 40 years of experience and specialization in areas of Corporate Tax, Mergers or Demergers, Restructuring and Acquisitions. He worked as the Executive Vice-President, Group Taxation of the UB Group, Bangalore. K K Balu holds a degree in B.A and B.L and is a Corporate Lawyer having over 50 years of Legal, Teaching and Judicial experience.

K K Balu holds a degree in B.A and B.L and is a Corporate Lawyer having over 50 years of Legal, Teaching and Judicial experience. Justice M. Jaichandren hails from an illustrious family of lawyers, academics and politicians. Justice Jaichandren majored in criminology and then qualified as a lawyer by securing a gold medal. He successfully practiced in the Madras High Court and appeared in several civil, criminal, consumer, labour, administrative and debt recovery tribunals. He held office as an Advocate for the Government (Writs Side) in Chennai and was on the panel of several government organizations as senior counsel. His true passion lay in practicing Constitutional laws with focus on writs in the Madras High Court. He was appointed Judge, High Court of Madras in December 2005 and retired in February 2017.

Justice M. Jaichandren hails from an illustrious family of lawyers, academics and politicians. Justice Jaichandren majored in criminology and then qualified as a lawyer by securing a gold medal. He successfully practiced in the Madras High Court and appeared in several civil, criminal, consumer, labour, administrative and debt recovery tribunals. He held office as an Advocate for the Government (Writs Side) in Chennai and was on the panel of several government organizations as senior counsel. His true passion lay in practicing Constitutional laws with focus on writs in the Madras High Court. He was appointed Judge, High Court of Madras in December 2005 and retired in February 2017. S Balasubramanian is a Commerce and Law Graduate. He is a member of the Delhi Bar Council, an associate Member of the Institute of Chartered Accountants of India, the Institute of Company Secretaries of India and Management Accountants of India.

S Balasubramanian is a Commerce and Law Graduate. He is a member of the Delhi Bar Council, an associate Member of the Institute of Chartered Accountants of India, the Institute of Company Secretaries of India and Management Accountants of India.