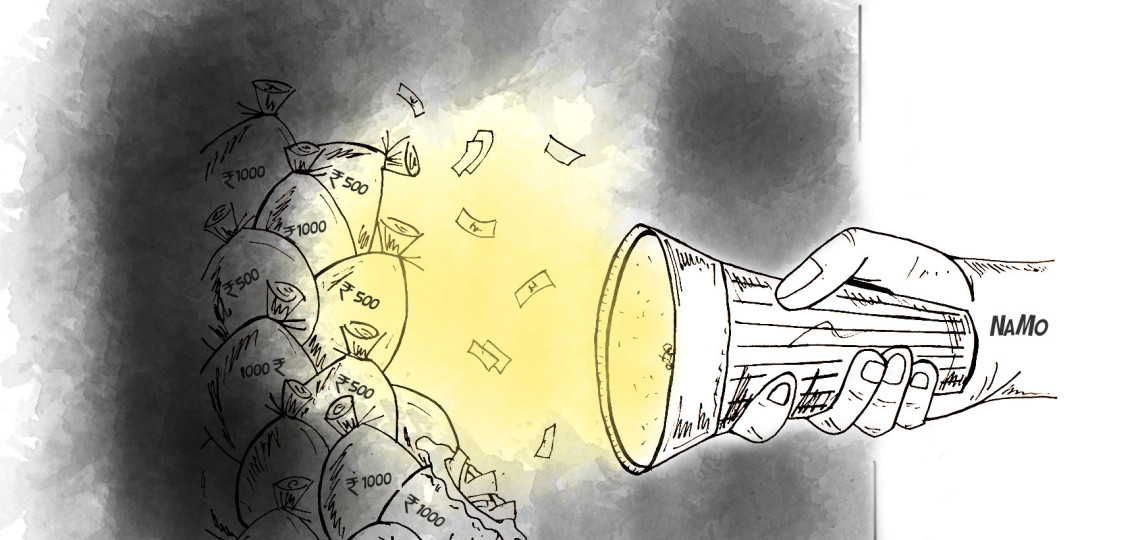

Invalidity of 500 and 1000 rupee notes -7 things you should know

So long, there was a perception that the Government’s response to address the issue of Black Money was piecemeal and inadequate. There is no doubt that manifestation of Black Money in social, economic and political space of our lives has a debilitating effect on the institutions of governance and conduct of public policy in the country.

This wealth may consist of income generated from legitimate activities or activities which are illegitimate per se, like smuggling, illicit trade in banned substances, arms trafficking, terrorism, corruption etc. However, generation of Black Money is through some of the methods such as out of book transactions, under reporting of production, manipulation by way of international transactions through associate enterprises, also generation is through some vulnerable sections of the economy added with land and real estate transactions domestically.

Prime Minister Mr. Narendra Modi’s announcement on the 8th November 2016 declaring the invalidity of the high denomination notes of Rs.500 and Rs.1000 is a brave measure in curbing black money. High denomination notes are known to facilitate generation of black money. In this connection, it may be noted that while the total number of bank notes in circulation is stated to have risen by 40% between 2011 and 2016, the increase in number of notes of Rs.500/- denomination was 76% and for Rs. 1,000/- denomination was 109% during this period. 1

The following are the major highlights of the Press Release dated 08.11.2016 of the Department of Economic Affairs:

- All ATMs, Cash Deposit Machines, Cash Recyclers and any other machine used for receipt and payment of cash will remain shut on 9th and 10th November, 2016.

- Withdrawals from ATMs would be restricted to Rs. 2,000/- per day per card up to November 18, 2016. The limit will be raised to Rs. 4,000/- per day per card from November 19, 2016 onwards.

- In case of medical emergencies etc. For first 72 hours from November 8 midnight i.e. till 11 November midnight government hospitals will accept these old notes, pharmacies in government hospitals will accept these notes with Doctor’s prescription.

- For first 72 hours, old notes will be accepted at petrol, diesel and CNG stations authorized by public sector companies, milk booths, crematoriums, and government co-operative stores.

- Cash withdrawals from a bank account, over the counter will be restricted to Rs. 10,000/- subject to an overall limit of Rs. 20,000/- in a week for the first fortnight, i.e., until the end of business hours on November 24, 2016.

- Old High Denomination Bank Notes may be deposited by individuals/persons into their bank accounts and/or exchanged in bank branches or Issue Offices of RBI till the close of business hours on 30th December, 2016.

- In case old notes are not deposited by 30th December, there is a possibility of exchanging old notes at designated offices of the RBI after submitting a declaration form and showing individuals/persons ID cards until 31st March 2017.

Notes:

- Press release dated 09.11.2016, Department of Economic Affairs ↩

External Commercial Borrowings (ECB) by start-ups

Companies (Registration Offices and Fees) Second Amendment Rules, 2016

Leave a comment

You must be logged in to post a comment.

He holds a Bachelor’s and Master’s Degree in Corporate Secretaryship and a Degree in Law. He is a Fellow member of the Institute of Company Secretaries of India and an Associate Member of the Corporate Governance Institute, UK and Ireland. He has also completed a program from ISB on ‘Value Creation through Mergers and Acquisitions.

He holds a Bachelor’s and Master’s Degree in Corporate Secretaryship and a Degree in Law. He is a Fellow member of the Institute of Company Secretaries of India and an Associate Member of the Corporate Governance Institute, UK and Ireland. He has also completed a program from ISB on ‘Value Creation through Mergers and Acquisitions. Mr P Muthusamy is an Indian Revenue Service (IRS) officer with an outstanding career of 30+ years of experience and expertise in all niche areas of Indirect Taxes covering a wide spectrum including GST, Customs, GATT Valuation, Central Excise and Foreign Trade.

Mr P Muthusamy is an Indian Revenue Service (IRS) officer with an outstanding career of 30+ years of experience and expertise in all niche areas of Indirect Taxes covering a wide spectrum including GST, Customs, GATT Valuation, Central Excise and Foreign Trade. During his judicial role, he heard and decided a large number of cases, including some of the most sensitive, complicated, and high-stake matters on insolvency and bankruptcy, including many cases on resolution plans, shareholder disputes and Schemes of Amalgamation, De-mergers, restructuring etc.,

During his judicial role, he heard and decided a large number of cases, including some of the most sensitive, complicated, and high-stake matters on insolvency and bankruptcy, including many cases on resolution plans, shareholder disputes and Schemes of Amalgamation, De-mergers, restructuring etc., Ms. Sarah Abraham has been enrolled with the Bar Council of Tamil Nadu since 1998. Her areas of practice include Shareholder Disputes, Corporate Compliances, Mergers and Acquisitions, Private Equity/ Venture Capital Agreements and allied disputes, Information Technology Contracts, Intellectual Property, General Commercial Agreements, Litigation, Arbitration and Mediation.

Ms. Sarah Abraham has been enrolled with the Bar Council of Tamil Nadu since 1998. Her areas of practice include Shareholder Disputes, Corporate Compliances, Mergers and Acquisitions, Private Equity/ Venture Capital Agreements and allied disputes, Information Technology Contracts, Intellectual Property, General Commercial Agreements, Litigation, Arbitration and Mediation. A K Mylsamy is the Founder, Managing Partner and the anchor of the firm. He holds a Degree in law and a Degree in Literature. He is enrolled with the Bar Council of Tamil Nadu.

A K Mylsamy is the Founder, Managing Partner and the anchor of the firm. He holds a Degree in law and a Degree in Literature. He is enrolled with the Bar Council of Tamil Nadu. M Subathra holds a Degree in law and a Master’s Degree in International Business Law from the University of Manchester, United Kingdom. She is enrolled with the Bar Council of Tamil Nadu.

M Subathra holds a Degree in law and a Master’s Degree in International Business Law from the University of Manchester, United Kingdom. She is enrolled with the Bar Council of Tamil Nadu. Mr. K Rajendran is a former Indian Revenue Service (IRS) officer with a distinguished service of 35 years in the Indirect Taxation Department with rich experience and expertise in the fields of Customs, Central Excise, Service Tax and GST. He possesses Master’s Degree in English literature. Prior to joining the Department, he served for the All India Radio, Coimbatore for a period of about 4 years.

Mr. K Rajendran is a former Indian Revenue Service (IRS) officer with a distinguished service of 35 years in the Indirect Taxation Department with rich experience and expertise in the fields of Customs, Central Excise, Service Tax and GST. He possesses Master’s Degree in English literature. Prior to joining the Department, he served for the All India Radio, Coimbatore for a period of about 4 years. An MBA from the Indian Institute of Management, Calcutta, and an M.Sc. in Tourism Management from the Scottish Hotel School, UK, Ashok Anantram was one fo the earliest IIM graduates to enter the Indian hospitality industry. He joined India Tourism Development Corporation (ITDC) in 1970 and after a brief stint proceeded to the UK on a scholarship. On his return to India, he joined ITC Hotels Limited in 1975. Over the 30 years in this Organisation, he held senior leadership positions in Sales & Marketing and was its Vice President – Sales & Marketing. He was closely involved in decision making at the corporate level and saw the chain grow from a single hotel in 1975 to a very large multi-brand professional hospitality group.

An MBA from the Indian Institute of Management, Calcutta, and an M.Sc. in Tourism Management from the Scottish Hotel School, UK, Ashok Anantram was one fo the earliest IIM graduates to enter the Indian hospitality industry. He joined India Tourism Development Corporation (ITDC) in 1970 and after a brief stint proceeded to the UK on a scholarship. On his return to India, he joined ITC Hotels Limited in 1975. Over the 30 years in this Organisation, he held senior leadership positions in Sales & Marketing and was its Vice President – Sales & Marketing. He was closely involved in decision making at the corporate level and saw the chain grow from a single hotel in 1975 to a very large multi-brand professional hospitality group. Mani holds a Bachelor Degree in Science and P.G. Diploma in Journalism and Public Relations. He has a rich and varied experience of over 4 decades in Banking, Finance, Hospitality and freelance Journalism. He began his career with Andhra Bank and had the benefit of several training programs in Banking.

Mani holds a Bachelor Degree in Science and P.G. Diploma in Journalism and Public Relations. He has a rich and varied experience of over 4 decades in Banking, Finance, Hospitality and freelance Journalism. He began his career with Andhra Bank and had the benefit of several training programs in Banking. Mr. Kailash Chandra Kala joined the Department of Revenue, Ministry of Finance as ‘Customs Appraiser’ at Mumbai in the year 1993.

Mr. Kailash Chandra Kala joined the Department of Revenue, Ministry of Finance as ‘Customs Appraiser’ at Mumbai in the year 1993.

S Ramanujam, is a Chartered Accountant with over 40 years of experience and specialization in areas of Corporate Tax, Mergers or Demergers, Restructuring and Acquisitions. He worked as the Executive Vice-President, Group Taxation of the UB Group, Bangalore.

S Ramanujam, is a Chartered Accountant with over 40 years of experience and specialization in areas of Corporate Tax, Mergers or Demergers, Restructuring and Acquisitions. He worked as the Executive Vice-President, Group Taxation of the UB Group, Bangalore. K K Balu holds a degree in B.A and B.L and is a Corporate Lawyer having over 50 years of Legal, Teaching and Judicial experience.

K K Balu holds a degree in B.A and B.L and is a Corporate Lawyer having over 50 years of Legal, Teaching and Judicial experience. Justice M. Jaichandren hails from an illustrious family of lawyers, academics and politicians. Justice Jaichandren majored in criminology and then qualified as a lawyer by securing a gold medal. He successfully practiced in the Madras High Court and appeared in several civil, criminal, consumer, labour, administrative and debt recovery tribunals. He held office as an Advocate for the Government (Writs Side) in Chennai and was on the panel of several government organizations as senior counsel. His true passion lay in practicing Constitutional laws with focus on writs in the Madras High Court. He was appointed Judge, High Court of Madras in December 2005 and retired in February 2017.

Justice M. Jaichandren hails from an illustrious family of lawyers, academics and politicians. Justice Jaichandren majored in criminology and then qualified as a lawyer by securing a gold medal. He successfully practiced in the Madras High Court and appeared in several civil, criminal, consumer, labour, administrative and debt recovery tribunals. He held office as an Advocate for the Government (Writs Side) in Chennai and was on the panel of several government organizations as senior counsel. His true passion lay in practicing Constitutional laws with focus on writs in the Madras High Court. He was appointed Judge, High Court of Madras in December 2005 and retired in February 2017. S Balasubramanian is a Commerce and Law Graduate. He is a member of the Delhi Bar Council, an associate Member of the Institute of Chartered Accountants of India, the Institute of Company Secretaries of India and Management Accountants of India.

S Balasubramanian is a Commerce and Law Graduate. He is a member of the Delhi Bar Council, an associate Member of the Institute of Chartered Accountants of India, the Institute of Company Secretaries of India and Management Accountants of India.