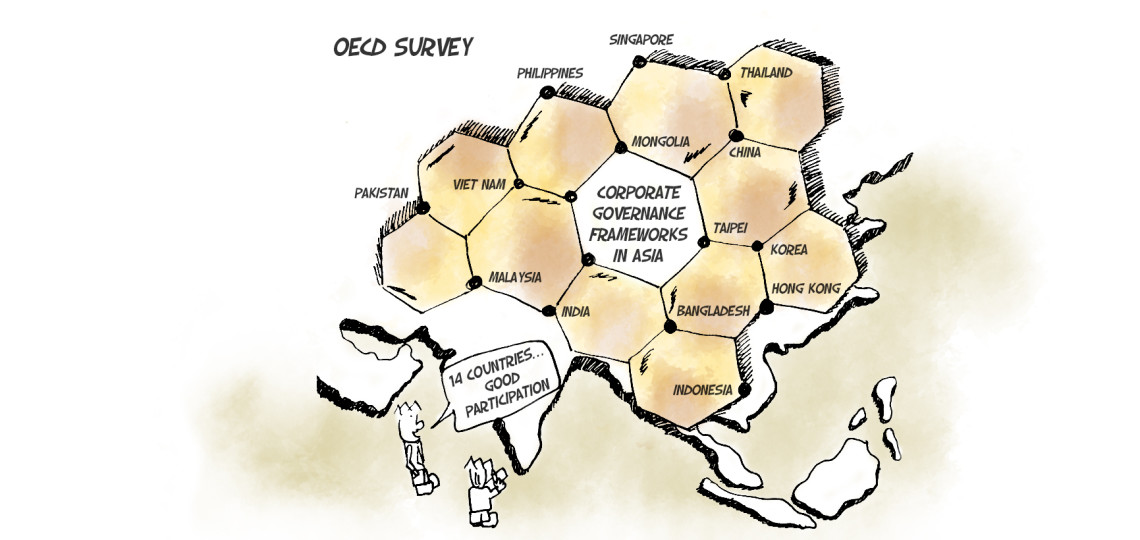

OECD’s study on Corporate Governance Frameworks in Asia

The Organisation for Economic Co-operation and Development (OECD) is a Paris based intergovernmental economic organisation whose objective is to stimulate economic progress and world trade. It provides a forum in which governments can work together to share experiences and seek solutions to common problems. India is at present only a member of various committees of the organisation. One of the main objectives pursued by the OECD is to disseminate accurate and up to date information on prevailing standards and practices on various issues.

In May 2016 the OECD undertook a comprehensive survey on corporate governance frameworks across 14 Asian countries. This survey reflected the Asian perspective in terms of evolution, standards and practices of corporate governance policies in countries such as Bangladesh, China, Taipei, Hong Kong, India, Indonesia, Korea, Malaysia, Mongolia, Pakistan, Philippines, Singapore, Thailand and Viet Nam. A snapshot of the survey:

Sl.No. |

Issue |

OECD Survey result |

|

1. |

Regulatory framework

|

All 14 Asian countries have laws and other regulations which are constantly updated. In India, there is the Companies Act, 2013, SEBI laws relating to LODR and stock exchanges Acts. |

|

2. |

Ownership structure at company level |

Listed companies in most Asian countries had concentrated ownership structures. Of the participating countries, only China and Viet Nam had companies with substantial state ownership. All other countries including India maintained significant family ownership structures. |

| 3. |

Custodian / Regulators of codes and principles |

All countries have a structured set up of custodian and or regulators of codes and principles. Most bodies are governed by Chairman, Board members and members. Of the 14 Asian countries, 11 countries had regulators which are public initiative. While in 7 countries the regulatory bodies have public funding, the remaining had either private funding or mixed funding. In India, while the Ministry of Company affairs is central government initiative which is publicly funded, the SEBI is an independent watch dog is self-funded. |

| 4. |

Other organizations that promote improvement of Corporate Governance |

All Asian countries except Bangladesh, China, Taipei, Hong Kong and Mongolia have ad hoc agencies or other entities that promote CG policies of the government. However only Bangladesh and Viet Nam have special courts to litigate CG matters. In India the National Foundation of Corporate Governance propagates the CG policies of the government. |

| 5. |

Implementation mechanism

|

The laws relating to CG compliance have continuously evolved from 2006 onwards. While China, Indonesia, Korea have adopted the CG procedures voluntarily, most other Asian countries are bound to comply with the CG laws. All countries except Indonesia have to disclose CG related compliance in the company annual report or Corporate governance report. India is governed by the Corporate Governance guidelines. |

| 6. |

Self-listing of stock exchanges and mode of funding |

75% of the participating Asian Countries are not self-listed stock exchanges. This includes India also. Only countries like Hong Kong, China, Malaysia, Philippines and Singapore are self-listed. 71% of the countries’ stock exchanges are self-funded. In India, both NSE & BSE are self –funded. |

| 7. |

Key shareholder rights |

Available as per respective laws of all participating Asian countries. · Minimum prior notice for convening shareholder meeting minimum of 7 days (Thailand) upto 30 days (Mongolia). In India it is 21 days · Shareholder voting rights Available in most participating Asia countries.

|

| 8. |

Disclosure of related party transactions and approvals |

All participating countries have stringent laws relating to disclosure of related party transactions with varying thresholding limits. In all jurisdictions, related parties are required to abstain from voting on interested transactions. So far as approvals are concerned, Indonesia, Malaysia and Singapore require only shareholder approval while Pakistan and Philippines require only Board approval. All other countries including India require approvals from Board and shareholders. |

| 9. |

Board structure, size; committees |

Most Boards are one tier or unitary Boards. Only China, Indonesia and Viet Nam have two tier dual Boards. The Size of Boards vary across countries from a minimum of 2 upto a maximum of “no limits”. All countries have regulations to form various committees – Audit, Nomination, Remuneration, Risk management. Few countries have CG, HR & RPT committees. |

| 10. |

Directors’ qualifications

|

Fit & proper test – all Asian countries contain provision like disqualifications if found to be of unsound mind, insolvent etc.

Minimum education & training; Professional experience – only Bangladesh, Taipei, Indonesia, Malaysia, Mongolia, Pakistan, Philippines, Viet Nam & Singapore prescribe education qualification. |

| 11. |

Disclosure of director’s compensation |

Majority of participating Asian countries have requirement in their laws to disclose director’s compensation. Only Bangladesh, Korea, Malaysia and Singapore do not have mandatory requirements. |

| 12. |

Women on Boards and in senior management

|

Bangladesh, Mongolia, Pakistan & Viet Nam was not covered under this. The country with the lease representation on the Board as well as in the senior management was Korea. Malaysia had the maximum number of women representation on the Board. India stands reasonably behind Malaysia. |

Conclusion

The OECD originally developed principles of corporate governance in 1999 and updated subsequently in 2004 and 2015. In 2016 it undertook the survey which threw light on the evolution of legal, regulatory and institutional framework for corporate governance practices of listed companies of 14 Asian countries. The survey is exhaustive and objective as OECD has built on the expertise of securities regulators, institute of directors, corporate governance centres, stock exchanges, listed companies. The OECD survey reiterates importance given to CG compliance by emerging and developed economies alike. Almost all economies endeavour to keep pace with the dynamic corporate governance laws. The principles have been adopted as one of the key standards for sound financial and compliance systems. They have been used by the World Bank in their country wise reviews. They also serve as the basis for guidelines on corporate governance.

He holds a Bachelor’s and Master’s Degree in Corporate Secretaryship and a Degree in Law. He is a Fellow member of the Institute of Company Secretaries of India and an Associate Member of the Corporate Governance Institute, UK and Ireland. He has also completed a program from ISB on ‘Value Creation through Mergers and Acquisitions.

He holds a Bachelor’s and Master’s Degree in Corporate Secretaryship and a Degree in Law. He is a Fellow member of the Institute of Company Secretaries of India and an Associate Member of the Corporate Governance Institute, UK and Ireland. He has also completed a program from ISB on ‘Value Creation through Mergers and Acquisitions. Mr P Muthusamy is an Indian Revenue Service (IRS) officer with an outstanding career of 30+ years of experience and expertise in all niche areas of Indirect Taxes covering a wide spectrum including GST, Customs, GATT Valuation, Central Excise and Foreign Trade.

Mr P Muthusamy is an Indian Revenue Service (IRS) officer with an outstanding career of 30+ years of experience and expertise in all niche areas of Indirect Taxes covering a wide spectrum including GST, Customs, GATT Valuation, Central Excise and Foreign Trade. During his judicial role, he heard and decided a large number of cases, including some of the most sensitive, complicated, and high-stake matters on insolvency and bankruptcy, including many cases on resolution plans, shareholder disputes and Schemes of Amalgamation, De-mergers, restructuring etc.,

During his judicial role, he heard and decided a large number of cases, including some of the most sensitive, complicated, and high-stake matters on insolvency and bankruptcy, including many cases on resolution plans, shareholder disputes and Schemes of Amalgamation, De-mergers, restructuring etc., Ms. Sarah Abraham has been enrolled with the Bar Council of Tamil Nadu since 1998. Her areas of practice include Shareholder Disputes, Corporate Compliances, Mergers and Acquisitions, Private Equity/ Venture Capital Agreements and allied disputes, Information Technology Contracts, Intellectual Property, General Commercial Agreements, Litigation, Arbitration and Mediation.

Ms. Sarah Abraham has been enrolled with the Bar Council of Tamil Nadu since 1998. Her areas of practice include Shareholder Disputes, Corporate Compliances, Mergers and Acquisitions, Private Equity/ Venture Capital Agreements and allied disputes, Information Technology Contracts, Intellectual Property, General Commercial Agreements, Litigation, Arbitration and Mediation. A K Mylsamy is the Founder, Managing Partner and the anchor of the firm. He holds a Degree in law and a Degree in Literature. He is enrolled with the Bar Council of Tamil Nadu.

A K Mylsamy is the Founder, Managing Partner and the anchor of the firm. He holds a Degree in law and a Degree in Literature. He is enrolled with the Bar Council of Tamil Nadu. M Subathra holds a Degree in law and a Master’s Degree in International Business Law from the University of Manchester, United Kingdom. She is enrolled with the Bar Council of Tamil Nadu.

M Subathra holds a Degree in law and a Master’s Degree in International Business Law from the University of Manchester, United Kingdom. She is enrolled with the Bar Council of Tamil Nadu. Mr. K Rajendran is a former Indian Revenue Service (IRS) officer with a distinguished service of 35 years in the Indirect Taxation Department with rich experience and expertise in the fields of Customs, Central Excise, Service Tax and GST. He possesses Master’s Degree in English literature. Prior to joining the Department, he served for the All India Radio, Coimbatore for a period of about 4 years.

Mr. K Rajendran is a former Indian Revenue Service (IRS) officer with a distinguished service of 35 years in the Indirect Taxation Department with rich experience and expertise in the fields of Customs, Central Excise, Service Tax and GST. He possesses Master’s Degree in English literature. Prior to joining the Department, he served for the All India Radio, Coimbatore for a period of about 4 years. An MBA from the Indian Institute of Management, Calcutta, and an M.Sc. in Tourism Management from the Scottish Hotel School, UK, Ashok Anantram was one fo the earliest IIM graduates to enter the Indian hospitality industry. He joined India Tourism Development Corporation (ITDC) in 1970 and after a brief stint proceeded to the UK on a scholarship. On his return to India, he joined ITC Hotels Limited in 1975. Over the 30 years in this Organisation, he held senior leadership positions in Sales & Marketing and was its Vice President – Sales & Marketing. He was closely involved in decision making at the corporate level and saw the chain grow from a single hotel in 1975 to a very large multi-brand professional hospitality group.

An MBA from the Indian Institute of Management, Calcutta, and an M.Sc. in Tourism Management from the Scottish Hotel School, UK, Ashok Anantram was one fo the earliest IIM graduates to enter the Indian hospitality industry. He joined India Tourism Development Corporation (ITDC) in 1970 and after a brief stint proceeded to the UK on a scholarship. On his return to India, he joined ITC Hotels Limited in 1975. Over the 30 years in this Organisation, he held senior leadership positions in Sales & Marketing and was its Vice President – Sales & Marketing. He was closely involved in decision making at the corporate level and saw the chain grow from a single hotel in 1975 to a very large multi-brand professional hospitality group. Mani holds a Bachelor Degree in Science and P.G. Diploma in Journalism and Public Relations. He has a rich and varied experience of over 4 decades in Banking, Finance, Hospitality and freelance Journalism. He began his career with Andhra Bank and had the benefit of several training programs in Banking.

Mani holds a Bachelor Degree in Science and P.G. Diploma in Journalism and Public Relations. He has a rich and varied experience of over 4 decades in Banking, Finance, Hospitality and freelance Journalism. He began his career with Andhra Bank and had the benefit of several training programs in Banking. Mr. Kailash Chandra Kala joined the Department of Revenue, Ministry of Finance as ‘Customs Appraiser’ at Mumbai in the year 1993.

Mr. Kailash Chandra Kala joined the Department of Revenue, Ministry of Finance as ‘Customs Appraiser’ at Mumbai in the year 1993.

S Ramanujam, is a Chartered Accountant with over 40 years of experience and specialization in areas of Corporate Tax, Mergers or Demergers, Restructuring and Acquisitions. He worked as the Executive Vice-President, Group Taxation of the UB Group, Bangalore.

S Ramanujam, is a Chartered Accountant with over 40 years of experience and specialization in areas of Corporate Tax, Mergers or Demergers, Restructuring and Acquisitions. He worked as the Executive Vice-President, Group Taxation of the UB Group, Bangalore. K K Balu holds a degree in B.A and B.L and is a Corporate Lawyer having over 50 years of Legal, Teaching and Judicial experience.

K K Balu holds a degree in B.A and B.L and is a Corporate Lawyer having over 50 years of Legal, Teaching and Judicial experience. Justice M. Jaichandren hails from an illustrious family of lawyers, academics and politicians. Justice Jaichandren majored in criminology and then qualified as a lawyer by securing a gold medal. He successfully practiced in the Madras High Court and appeared in several civil, criminal, consumer, labour, administrative and debt recovery tribunals. He held office as an Advocate for the Government (Writs Side) in Chennai and was on the panel of several government organizations as senior counsel. His true passion lay in practicing Constitutional laws with focus on writs in the Madras High Court. He was appointed Judge, High Court of Madras in December 2005 and retired in February 2017.

Justice M. Jaichandren hails from an illustrious family of lawyers, academics and politicians. Justice Jaichandren majored in criminology and then qualified as a lawyer by securing a gold medal. He successfully practiced in the Madras High Court and appeared in several civil, criminal, consumer, labour, administrative and debt recovery tribunals. He held office as an Advocate for the Government (Writs Side) in Chennai and was on the panel of several government organizations as senior counsel. His true passion lay in practicing Constitutional laws with focus on writs in the Madras High Court. He was appointed Judge, High Court of Madras in December 2005 and retired in February 2017. S Balasubramanian is a Commerce and Law Graduate. He is a member of the Delhi Bar Council, an associate Member of the Institute of Chartered Accountants of India, the Institute of Company Secretaries of India and Management Accountants of India.

S Balasubramanian is a Commerce and Law Graduate. He is a member of the Delhi Bar Council, an associate Member of the Institute of Chartered Accountants of India, the Institute of Company Secretaries of India and Management Accountants of India.